FAQ

Frequently asked questions about sustainable real estate

What is sustainability in real estate?

Sustainability in real estate is a set of practices and principles that aim to minimize the environmental impact of buildings and communities while also promoting economic viability and social well-being. While green building mostly relates to ecological aspects, sustainability in real estate is much more than eco buildings. Sustainable real estate is achieved through the use of environmentally friendly and energy-efficient technologies, materials, and processes in the design, construction, operation, and maintenance of real estate assets. However, the ultimate goal is to create properties that are resilient, resource-efficient, and able to meet the needs of both current and future generations, which also include social aspects. A hot tip: Building sustainability concepts and green building standards are the way to go.

What impact does climate change have on real estate?

How will ESG impact the real estate business?

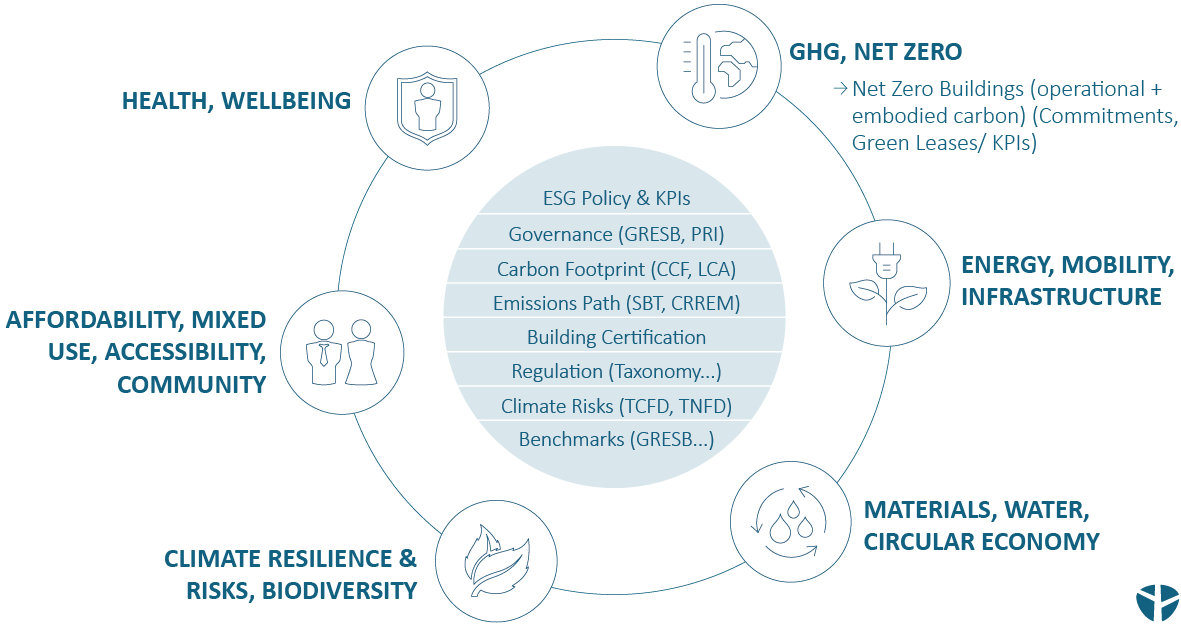

Environmental, Social, and Governance (ESG) considerations are becoming increasingly important in the real estate industry. As a result, real estate has to focus on ways to reduce the carbon footprint, improve social outcomes, and operate with transparency and ethics. The integration of ESG practices into the real estate industry can drive long-term value and success for companies, while also contributing to a more sustainable and inclusive world. If you want to know how you can benefit from ESG practices in your real estate business, get in touch with our real estate sustainability experts.