FAQ

Frequently asked questions on materiality assessment

I’m already aware of my material topics. Do I still have to conduct a materiality analysis?

Topics, that are material based on past analysis can be an indication. However, there are two overarching and important reasons why a company benefits from an up-to-date materiality analysis. First: A materiality assessment can be seen as an early warning system that points out opportunities and risks in good time. Legal requirements, social changes and economic trends – all of these and much more can have an impact on the conditions in which a company finds itself. The dynamics of today’s world lead to rapid changes in priorities. New topics can therefore emerge at short notice and become material for a company. You should not miss out on this advantage in knowledge.

Secondly, if your company falls under the scope of the CSRD, your double materiality analysis must meet its requirements as it defines a modern approach. As sustainability information disclosed as part of non-financial reporting is audited externally, the question also arises here as to whether the status quo of information appears plausible to the auditor. Finally, the results of the materiality analysis form the basis for the application of the ESRS. Ultimately, regularly monitoring external influences about their significance for a company is also a question of CSRD due diligence.

Materiality assessment vs risk management: How are the two related?

You can derive strategic benefits if you understand and implement the double materiality assessment in the context of your risk management. Risk management is concerned with identifying, assessing and mitigating potential risks to a company’s economic success and future. Typical risks are of financial, operational, and reputational nature. Also, compliance-related risks can influence your business. Risk management allows you to implement strategies to manage or minimize the impact.

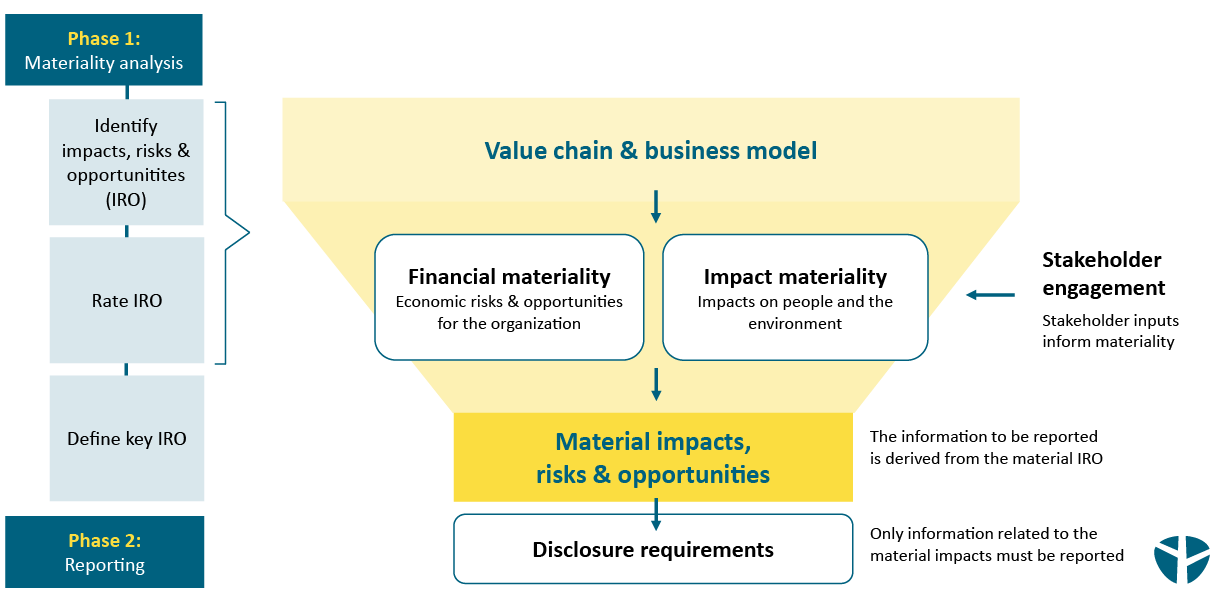

The core of the double materiality assessment lies partly in creating transparency and a foundation for dealing with sustainability-related risks. Thus, there are overlaps between an existing risk management and the financial materiality perspective in the context of a double materiality assessment. We support our customers in creating synergies between the two approaches, e.g. by considering the future integration of ESG-related risks into your existing risk management system.

What are the challenges of a sustainability-related double materiality assessment?

There are several challenges of a double materiality assessment, that should be managed and prepared for the success of the whole process. On the one hand, we can observe, that companies tend to limit it to what is necessary for regulatory purposes instead of recognizing its strategic relevance. As a result, double materiality assessment is often given too little focus and resources. This is particularly the case if top management cannot be won over to the process and there is a lack of support. On the other hand, profound analysis and stakeholder dialogs can be time-consuming, overwhelming and costly, especially if covered internally. In such situations, good preparation and individual solutions help.

How do I ensure to carry out the process in a way that withstands a materiality assessment audit?

The information disclosed under the CSRD is subject to an external audit requirement. This also includes the documentation of the implementation and results of the materiality analysis. Following the EFRAG implementation guidance for materiality assessment is the first important step. In addition, we recommend that you see the materiality analysis as a helpful tool that guarantees transparency and provides you with information that can affect your business positively and negatively in future. Due to its relevance, we recommend allocating sufficient resources and focusing intensively on the process. This will automatically be reflected in the quality that the external audit also requires. Also, experience shows that a proactive exchange with auditors helps to clarify issues. Moreover, external support and consultancy underline the quality of the implementation and documentation, which is also a reasonable steps to meet the requirements.

Materiality assessment GRI vs CSRD: What is the difference?

The CSRD is a legally binding EU directive, while the Global Reporting Initiative (GRI) provides voluntary, albeit widespread, sustainability reporting standards. Even if GRI is still working on updates, it can be assumed that the GRI standards will lose importance in the EU, especially as the CSRD and ESRS are partly based on GRI. If a company has already set up its sustainability reporting in accordance with GRI, this is to a certain extent a sign of quality for the disclosure of sustainability information. At the same time, it is a good starting point for working towards CSRD compliance.

Materiality assessment frequency: How often should I repeat the process?

There are no exact specifications as to how often a double materiality assessment must be carried out in the course of the CSRD. The principle of appropriateness applies. Good practice shows that a two-year cycle makes sense on average. Some companies also opt for an annual analysis or alternate annually between a deep dive and a re-evaluation. However, the answer to the question ultimately leads to plausibility for the auditor and compliance with corporate due diligence, which is crucial.

Ultimately, the idea of dynamic materiality should be understood as a helpful outlook into the future: The more regularly you deal with it, the closer you are to the topics that could develop into a risk, possibly even financially, or an opportunity that you do not want to miss. ESG topics that are not yet acute for a company today, but represent an opportunity or risk in the future, can be proactively and actively managed through a regularly conducted materiality analysis. This gives you the time to build up the necessary structures and resources and consider sensible strategies instead of acting reactively under time pressure. In this way, you are one step ahead and due diligence requirements can also be partially covered. This means that a regular double materiality analysis is valuable for the stability of your business model.

Is the ESRS E1 Climate change always material for a company?

No, the so-called ESRS E1 climate standard is not mandatory material for a company. The idea of mandatory materiality for climate change goes back to earlier EFRAG drafts. However, the final version defines the materiality assessment as a tool to determine the material topics. Therefore, it depends on the results of your analysis whether climate change is material for a company. However, only in rare exceptional cases, if at all, can it be argued that climate change is not material from either a financial or an impact perspective.

For example, transitory and physical risks caused by climate change can have a negative financial impact on your business success. On the other hand, addressing your individual climate risks in good time can lead to previously unimagined opportunities.